A new setting has been added that can control when miscellaneous deductions are taken out on an employee’s check. The new setting provides some new capabilities and solves a couple of problems that customers have had when it comes to controlling when deductions are taken. The new setting is available in version 7.37.1155 or higher of The Farmer’s Office and The Labor Contractor’s Office.

The new setting is called “Frequency” and may be set to the following values:

- Each Check

- One Time

- Weekly

- Biweekly

- Monthly

- Annually

The default value for the new Frequency setting is “Each Check”. This will be set on all existing employee accounts and will be the default value on new accounts that are entered. The “Each Check” setting will cause the program to operate as it always has. If you don’t need to use the new setting, you do not need to do anything.

Along with the Frequency setting, the program will now keep track of the last date that each deduction was withheld on employee’s check. This “Last Deducted On” date is used in combination with the Frequency setting to control when deductions should be taken.

At first glance, this setting might seem similar to the existing Weeks setting, which also controls when deductions are taken out on employee checks. There are some important differences, however. And for most deductions, you will either use the Weeks setting or the Frequency setting, but usually not both at the same time.

Review: How the “Weeks” Setting Works

First, a quick review of how the Weeks setting works. It allows you to specify which weeks of the month a deduction amount should be withheld. When left blank (the default), the deduction will be taken out on all checks issued to the employee. If you enter “1”, “2”, “3”, “4”, “5” or any combination of these numbers, then the program will only take the deduction when the Week Ending Date (see below) matches a week number that you’ve entered. The week number correspond to the following dates in each month:

- First Week: 1st through the 7th

- Second Week: 8th through the 14th

- Third Week: 15th through the 21st

- Fourth Week: 22nd through the 28th

- Fifth Week: 29th through the 31st (Normally not used)

The intent of using the week number is to only have deductions withheld for specific pay periods during the month. For instance, if you have a specific amount each month that must be deducted from the employee’s checks and you want to break it up into four equal deductions, entering “1234” for the weeks will cause the deduction to be withheld for those four weeks only. In months where the Week Ending Date is from the 29th to the 31st, the program will not withhold the deduction on that check.

Similarly, if you want to withhold a monthly amount on two separate checks, you might enter “13” or “24” to withhold the amount only for those two specific weeks of the month.

There are some limitations to using the Weeks setting. For instance, if a deduction is scheduled only for the 1st week of the month and the employee does not receive a pay check for that week, then the deduction will obviously not be taken out. If the employee receives a check for the 2nd week, the program will still not include the deduction on that check, because the deduction is defined to only be taken out on the 1st week.

The Week Ending Date

Up until recently, the Week Ending Date has always been the same as the Payroll Ending Date entered on Payroll Check entry. This date has been the basis for determining what week number the check is in, and thus whether or not any deductions that have a setting in the Weeks entry should be withheld. This is because during payroll check entry, this is the only date that is known. The check date is not assigned until checks are printed, so the program wasn’t able to base the week number calculation on the check date.

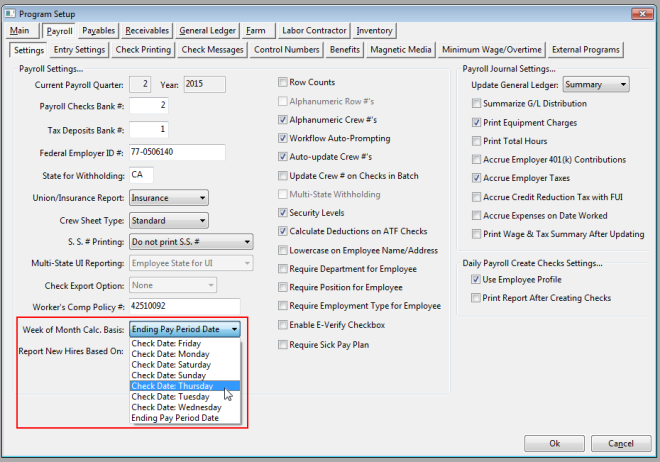

A new setting added under Program Setup->Payroll->Settings called Week of Month Calc. Basis allows you to change this behavior and base the week number calculation on the check date. The default value for this setting is “Ending Pay Period Date”, which means the program will operate as it always has unless you change it.

If you want to use the Check Date instead of the Ending Pay Period Date as the basis for the week number calculation, you can change this new setting to the day of the week that you normally issue checks. When payroll checks are entered (or created from Daily Payroll) the program will use this setting to determine what the expected check date will be, and then use that date to determine the week number.

Be very careful if you are planning on changing this setting! Depending on the current setting and the new setting that you choose, employees might either have deductions withheld twice or not at all!

Here is an example: Suppose your pay period runs from Monday to Sunday. For the pay period of 06/01/2015 through 06/07/2015, the week number based on the Payroll Ending date would be week #1. If you change the Week of Month Calc. Basis to “Check Date: Thursday”, then the program will determine the week number to be #2 because the check date will be 6/11/2015, and this date falls in week #2.

The Frequency Setting

The Frequency setting lets you tell the program how often the deduction should be withheld. It is different from the Weeks setting in that it is not tied at all to the weeks of the month. Instead, the program keeps track of the last time that each deduction was withheld from the employee account, and determines whether or not it is time to withhold the deduction again based on the setting that you enter for the Frequency.

The Last Deducted On setting will be automatically maintained and updated by the program. When a check is printed, the dates for any miscellaneous deductions taken on the check will be updated with the Week Ending Date (see above for an explanation of the Week Ending Date) except for Monthly and Annual deductions (see below for an explanation of how these settings work).

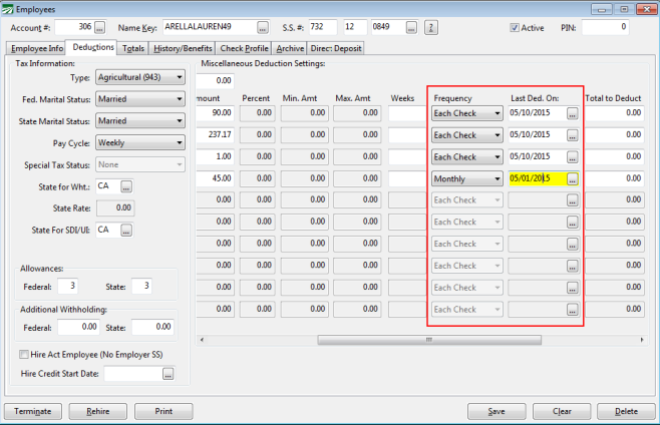

The Frequency and Last Deducted On settings appear between the Weeks and the Total to Deduct settings in the Miscellaneous Deduction Settings section:

There are six different settings available for the Frequency setting:

Each Check: This is the default setting for all existing miscellaneous deductions on existing employee accounts as well as for new employee accounts. Essentially this setting says “do nothing”. The program will continue to operate as before, including the deduction on each check (subject to the Weeks setting).

One Time. This option allows you to set up a deduction that will be withheld one time only. This could be useful for “catch up” deductions or other one time only deductions. When you set up a one-time deduction, make sure that the Last Deducted On date is blank. Do not enter a date in this entry. The logic used by the program is that the deduction will appear on the check only when the Last Deducted On date is blank. Once that check is printed, the Last Deducted On date will be updated with that check date. On the employee’s next check, it will not be taken out.

This means that you can set up a one-time deduction and re-activate that deduction by blanking out the Last Deducted On date if you need to withhold that deduction again.

The One Time setting is the only Frequency setting that you may want to combine with the Weeks setting. This would apply in a situation where you both have a deduction that is to be taken out only for certain weeks of the month and you issue multiple checks to the employee.

Weekly. This setting will withhold the deduction on a weekly basis. This might seem redundant for employees that are set to a weekly pay cycle already. However, for employees that receive multiple checks for the same weekly pay period, this setting can be used to insure that the deduction is taken out only on the first check that is issued for that week.

An example: Some customers issue separate checks to employee that work on separate crews during the week. Suppose the employee has a deduction for health insurance that is to be taken out each week. Without using this setting, on the second (or even third) check issued to an employee with the health insurance deduction, you would have to manually zero out the deduction amount before printing the check, otherwise the health insurance deduction will be withheld multiple times.

When the Weekly Frequency setting is used, the program will update the Last Deducted On date after the employee’s first check has been printed. When the employees next check is entered (or created from Daily Payroll) the program will be able to determine based on the Last Deducted On date that the health insurance deduction was already taken for that pay period, and that it should not be taken on subsequent checks.

What happens if an employee doesn’t work for a week? The deduction will simply be taken on the next check. If seven or more days have elapsed since the deduction was last taken, then it will always be taken on the next check that is issued.

Biweekly. This setting allows you to specify that a deduction should be withheld every two weeks. This will result in a deduction that is withheld 26 times during the year for employees that are on a weekly pay cycle and who receive a check each week of the year.

If an employee does not receive a check for a week when a biweekly deduction is schedule to be taken, the deduction will be taken out on the next check that the employee receives and the deductions will continue on a biweekly basis from that point on.

Monthly. A monthly deduction will be withheld once per month, on or after one month from the Last Deducted On date.

Annual. A monthly deduction will be withheld once per year, on or after one year from the Last Deducted On date.

When setting up a deduction to be taken out on a monthly or annual basis, you may want to manually enter the Last Deducted On date so that the next deduction is taken out when you want it to. The Last Deducted On is updated slightly differently for the Monthly and Annual settings. This is to avoid “slippage” in the Last Deducted On date when there are periods of time during which employees don’t receive checks.

For instance, suppose an employee is set to a Monthly deduction frequency and a deduction is withheld at the beginning of June. The next month, the employee doesn’t work for the first two weeks of July. On the third week of July, the employee receives a check and the deduction is withheld since it has been over a month since it was last taken. If the program updates the Last Deducted On date with the Week Ending Date (remember this is based on either the payroll check’s Payroll Ending Date or Check Date), then the new Last Deducted On date will be more than a month since the last time it was taken out. The next time that the deduction will be taken will then be a month from the Week Ending Date for that check.

Another way to think about it: When the Monthly or Annual settings are used, the Last Deducted On date acts as an “anniversary date” to determine when the next deduction should be taken. When a deduction is taken, it is always advanced to either the same day of the month (for the Monthly setting) or the same month/day (for the Annual setting).

When using the Monthly setting, if an entire month goes by where the employee doesn’t receive a check, then the Last Deducted On date will be advance to the month that the next check is issued in.

Example #1: The Last Deducted On date starts out at 5/1/2015. A deduction is taken out during the month of June, and the so date is advanced to 6/1/2015. The program will not take the deduction out again until a check is entered with a Week Ending Date of 7/1/2015 or later, i.e. one month after 6/1/2015. However, the employee does not work at all in the month of July. When he comes back to work in August, the deduction is taken out of his first check because it has been more than a month since the Last Deducted On date of 6/1/2015. The Last Deducted On date is then advanced to 8/1/2015 (because the employee didn’t work at all in July). The next time the deduction will be taken out will be on the check with a Week Ending Date on or after 9/1/2015.

Example #2: An annual deduction is set up with a Last Deducted Date of 6/1/2015. The program will not withhold the deduction until a check is issued with a Week Ending Date of 6/1/2016 or later. Once that happens, the Last Deducted On date will be advanced to 6/1/2016 (regardless of the Week Ending Date of the actual check that the deduction appears on). The next time the deduction will be taken out will be for the check with the Week Ending Date on or after 6/1/2017.

Getting Started

Although the Frequency setting is automatically set to “Each Check”, the Last Deducted On date is not set to anything. If you do not plan on using the Frequency setting, you do not need to do anything. But if you are planning on using this setting, you may want to have the program fill in the actual dates that the employee last had each of the deductions withheld. This can be done using the Update ‘Last Deducted On’ Dates utility option that is located on the Payroll->Utilities sub-menu. Click on the Start button, and then this option will read the most recent check for each employee that has miscellaneous deductions set up on their account, determine when the were last taken out, and set the Last Deducted On dates for each deduction.

If you do not use this utility, then the next time you print payroll checks, the program will start updating the Last Deducted On date for employees that are issued checks. In any case, the program always relies on the Last Deducted On date when determining whether or not to take a deduction on the employees’ checks. If the Last Deducted On date is blank, then the program will always take the deduction if the Frequency is set to One Time, Weekly, Biweekly, Monthly or Annual.

Health Insurance Deductions

A Frequency setting has also been added to the medical plan setup. This is because health insurance deductions typically need to be done on a weekly basis, and customers that issue multiple checks to employees for the same week (e.g. one check per crew that the employee worked on) would need to zero out the health insurance deduction on subsequent checks. By setting the Frequency to Weekly, this is no longer necessary.

You must be running version 7.39.177 of the Human Resource program or newer to have the Frequency setting on the Health Plan Setup window.

Just as on employee accounts, the Frequency setting on the Health Insurance Plan Setup window will be set to “Each Check” by default. This maintains the existing behavior of the program. If you want to change this to Weekly instead, you can change the setting on the Health Insurance Plan and then click on the Update Employees button. This will update all of the employees that are currently enrolled in the plan with the current settings–including the new Frequency setting–that are in the Health Insurance Plan Setup. This eliminates the need to edit each employee’s deduction setup individually.

Important Note: Before clicking on the Update Employees button, make sure that the Weeks setting is correct. This should either be blank if you want the health insurance deduction to be taken out on every weekly paycheck or it should contain the weeks of the month that you want the deduction withheld. Some previous versions of the program would revert the Weeks setting to a default setting of “1234” if the Weeks entry was blank, so you should doublecheck to make sure it is correct before updating all of your employee accounts.

If you have questions about how the new Frequency setting works or whether it can be used for specific situations, please leave comments below!