Recently a customer wanted to pay employees a base hourly rate plus an incentive piecework rate, and at the same time guarantee a minimum hourly pay rate. The payroll system has always had the Base Hourly+Incentive Piecework (BH/IP) wage types, but up until now, the program has only been able to perform the minimum wage verification check with these wage types.

(When we use the term “minimum wage verification”, it always refers to a check against the legal minimum wage as set by the state or federal governments. “Guaranteed wage verification” on the other hand always refers to a per hour rate check against a hourly rate that is higher than the minimum wage set by law.)

The Guaranteed Piecework wage type (GP) was designed to pay employees on a piece rate basis, but also guarantee a minimum hourly rate that is above the legal minimum wage. The roadblock to combining the two methods has always been that the code that performs the guaranteed hourly rate calculation was designed to look at each line item individually. In other words, the program checks the hours worked vs. the total earnings for each line to see if the guaranteed wage is met, and if not, it creates a line to make up the difference.

The problem with doing a guaranteed rate check with the BH/IP lines is that the total earnings from the two separate line items must be added together first, and then the hours retrieved from the BH line item to do the calculation. This just didn’t fit in with the way the guaranteed wage verification code was designed; and re-writing code like this from scratch is always a complicated proposition.

In the past, our recommendation to customers that wanted to combine a higher than minimum wage hourly rate guarantee with the BH/IP payment method is to simply override either the federal or the state minimum wage, entering your guaranteed hourly rate instead of the actual minimum wage. By doing this, the minimum wage verification in effect becomes a guaranteed rate verification.

There are drawbacks to doing this. For instance, if you have other piecework wages that you want checked against the legal minimum wage instead of a higher guaranteed rate, you’ll have to change the minimum wage back and forth. And you can’t mix these pay methods on the same check (because only one minimum wage can apply per check).

So we sat down to take another look at this, and discovered something interesting. Some time ago, the guaranteed wage calculation was revised so that it could combine similar lines (same day, grower, cost ID, job code, wage type) together and make a single guaranteed wage adjustment for the combined total of these lines instead of potentially making an individual adjustment for each line item.

That meant we were almost halfway there–all we need to do is add a way for the program to know that the BH/IP lines are “similar” and should be combined. Since the logic used to determine if line items were “similar” included matching the wage type, a new entry was added to the wage type setup window so that we can tell the program when two different wage types should be combined.

To start with, you’ll need to make sure that your Guaranteed Wage Verification Method is set to “Check combined lines” in the Program Setup window:

Next, the wage types need to be set up to use the Guaranteed Wage calculation. Before you change the BH/IP wage types, consider whether or not you want to keep them set up to do a minimum wage verification and create a new pair of wage types that will use the Guaranteed Wage calculation. If you don’t plan on needing both methods in the future, then you can go ahead and just modify the existing BH/IP wage types to use the guaranteed wage calculation.

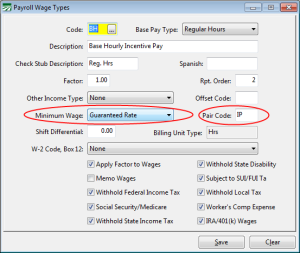

Change the Minimum Wage setting from “Minimum Wage” to “Guaranteed Rate”.

Notice the new entry to the right of the Minimum Wage entry for “Pair Code”. This entry is how the program knows that similar BH and IP line items are “paired” and should be combined together for the guaranteed rate calculation. On the BH wage type, the pair code is set to IP, and on the IP wage type, the pair code is set to BH. This is important if you set up your own codes. You must enter the corresponding wage type in the Pair Code entry on each wage type so that that guaranteed wage calculation will be done correctly.

This also applies if you have wage type for overtime base hour/incentive or doubletime base hourly/incentive. The BH and IP wage types are standard codes that have always existed. However, we never defined standard codes for overtime/doubletime hourly+incentive pay types. This means that when customers needed these codes, they set up their own codes and the program doesn’t necessarily know what they are, so you will need to manually enter the correct pair codes on any overtime/doubletime hourly+incentive wage types.

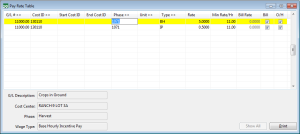

One last thing: There are two ways of setting the guaranteed hourly rate. The first is by setting an employee’s Pay Type to “Hourly” and entering the hourly rate on the account. The second is to set up a guaranteed pay rate in the Pay Rate Table. The Pay Rate Table will apply to all employees. To ensure that the program picks up the correct guaranteed hourly rate, you must add two entries in the Pay Rate Table, one for the hourly wage type and the other for the piecework wage type as shown here:

Now for an example:

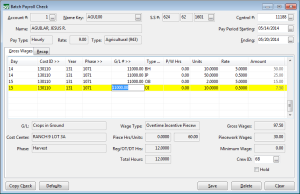

This employee is guaranteed an hourly rate of $9.00 (set up on his employee account). He worked ten hours at a base hourly rate of $5/hour and had a total for 50 units paid at .50/piece, for a total earnings of $75. For ten hours of work, the employee is guaranteed to make $90, so the program should add an adjustment of $15. In addition, he worked two overtime hours at the same base hourly rate, producing 10 pieces, for a total pay of $22.50. $9.00 at time and a half is $13.50, so for the overtime the employee should be paid a total of $27 for the overtime hours, requiring an adjustment of $4.50.

Minimum wage and guaranteed wage calculations are performed when you save the check. So after clicking on the save button, we bring the check back up to see that adjustments:

The arrows indicate the guaranteed wage adjustment lines that have been added.

If you use the Daily Payroll Entry, then the guaranteed wage calculations will be performed when you use the Create Checks option.

This new feature is available in version 7.3.813 or higher of The Farmer’s Office and The Labor Contractor’s Office. This version is not currently available via the Check for Updates option on the Tools menu. If you would like to be able to use this feature, contact Datatech Support and we can download the latest version to your system.