With the year end update approaching soon, we thought it would be a good idea to review how the program operates when it comes to downloading program updates and updates to federal and state tax rates.

There has always been a setting in the Tools->Program Setup window that controls whether or not the program will prompt you to check for updates. When we switched to all electronic delivery of program updates, the program was changed to always prompt you to check for updates from 12/15 to 2/28 each year, regardless of whether or not the Automatically Check for New Program Updates box is checked. This was done to make sure that all customers get notified when the Year End Update (or a supplemental update for year end reporting) is available

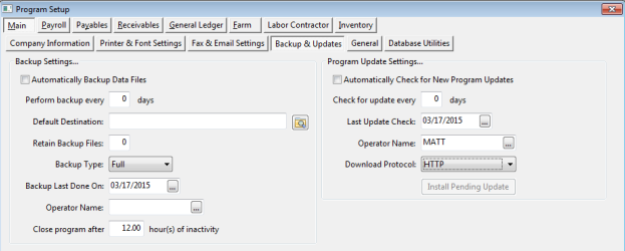

Here is a screenshot of the settings that control the program updates:

One important setting for customers with multiple users is the Operator Name. This should be set to your system administrator/office manager/accounting head honcho–whoever is going to be responsible for reviewing the Release Notes to see what changes have been made to the program and installing updates. Otherwise, if the Operator Name is left blank, the system will nag all users about checking for program updates.

If you haven’t checked the Automatically check for new program updates box, during the time period from 12/15 to 2/28 the program will by default automatically ask you to check for updates every seven days. If you do check this box and enter the number of days between checking for updates, the program will use that setting instead.

Tax Rate Updates

When the official Year End Update is released, it will include tax rate files for the new year. The tax rates do not need to be updated separately once the Year End Update is installed.

At times during the year, we may have updates to the federal or state tax rate files that are distributed independent of any program updates. This has been the case in prior year when there are provisional rates, changes mid year to tax tables or tax rates, support for new states is added, corrections are made to withholding tables, or there are updates to information that was not available in December (such as the H-2A minimum wages, which are released in January each year).

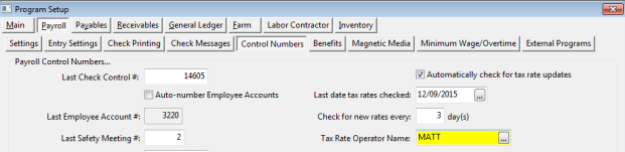

There are separate settings that control whether the program automatically checks for new tax rates. These setting are also located on the Program Setup window, under Payroll->Control Numbers:

Just as with with the program updates, if you haven’t checked the Automatically check for tax rate updates box, the program will still start checking automatically for updates from 12/15 to 1/31 and will alert you if new tax rates are available. Remember that once you have installed the Year End Update (which will include the tax rates for 2016) there may not be any separate updates to tax rates that you will need to install.

You can also designate a single operator who will be prompted to install new tax rates. If the Tax Rate Operator Name is left blank, then the program will check for new tax rates when any user is logged in. The first user that logs into the program when updates to tax rates are available would be the one that is prompted to install them.

Any questions? Please leave a comment below.