An amendment to the California Paid Sick Leave law provides an alternative option for calculating the sick pay hourly rate for variable pay rate employees. Employers may now use the employees weekly “regular rate of pay.” This weighted average calculation takes the total wages paid to the employee divided by the hours worked, to calculate the employees average hourly rate. This rate is then applied to the sick pay hours taken.

Either this method or the 90 day average rate method may be used. A longer period may be desired in operations that have a short harvest season and therefor some weeks the employees hourly rate may be drastically higher than other weeks in the 90 day window. Operations that pay bonuses or commissions on certain weeks may also prefer a longer average calculation method. However, one method should be established and documented for employees.

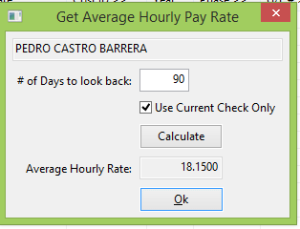

A tool has been added to the Batch Check Entry to calculate the average rate of pay for either period. To utilize this tool enter your sick pay line item(s). Right click on a line and press the Ctrl key and the R key. A “Get Average Hourly Pay Rate” box will pop-up. Select either 90 days or click the “Use Current Check” option to use the weekly method. Once the rate is calculated, click OK and the rate on the line item will be updated to the average rate.

If you enter time through Daily Payroll entry, enter your regular payroll and create checks as usual. Then, before printing checks, go into the Check Entry and add the sick pay as needed, following the instructions above.

We are currently working on combining the various rate adjustments, including non-productive rates, sick pay rates and minimum wage adjustments into one new batch check report/create checks option. More information on this will be available once completed. We hope these added features will continue to help our customers process payroll as efficiently as possible